Currently taking bets on "Musk admits wrongdoing and ensures that Twitter complies with the law" versus "Musk begins closing Twitter operations in Germany".Guys, he just likes Erdogan. Dude's a farce

Germany Threatens Twitter With €50 Million Fine For Failing To Tackle Illegal Content

Germany's Federal Office of Justice (BfJ) has launched proceedings against Twitter, claiming the company has failed to deal adequately with illegal content.www.forbes.com

Elon Musk's purchase of Twitter may soon go through

- Thread starter Specter Von Baren

- Start date

Optics not been healthy lately for Elmo.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ZQLLDYLXJBIZVMUE2TH2WQB6RI.jpg)

www.reuters.com

www.reuters.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ZQLLDYLXJBIZVMUE2TH2WQB6RI.jpg)

Elon Musk documents subpoenaed in Jeffrey Epstein lawsuit by US Virgin Islands

The Virgin Islands demanded any documents Musk has about Epstein’s involvement in human trafficking.

WILMINGTON, Delaware, May 15 (Reuters) - The U.S. Virgin Islands has subpoenaed Tesla Inc (TSLA.O) CEO Elon Musk for documents in its lawsuit accusing JPMorgan Chase & Co (JPM.N) of helping enable sexual abuses by late sex offender Jeffrey Epstein.

The subpoena, issued on April 28, came to light on Monday in a request by the Virgin Islands to serve Musk by alternative means because it had been unable to locate and serve him.

The U.S. territory did not seek to question Musk under oath, and its effort to subpoena him does not implicate him in any wrongdoing.

According to the Monday court filing in U.S. District Court in Manhattan, Musk, one of the richest people in the world, may have been referred to JPMorgan by Epstein. The Virgin Islands did not provide further explanation for its interest in obtaining documents from Musk.

In a tweet late on Monday, Musk said that the notion that he would listen to financial advice from Epstein was absurd.

Referring to Epstein, he said: "That cretin never advised me on anything whatsoever."

Epstein died by suicide in 2019 in a Manhattan jail cell while awaiting trial on sex trafficking charges.

The U.S. Virgin Islands accuses JPMorgan of missing red flags about Epstein's abuse of women on Little St. James, a private island he owned there.

The bank has denied knowledge of Epstein's crimes.

In the subpoena, the Virgin Islands demanded any documents Musk has about Epstein’s involvement in human trafficking and his procurement of girls or women for commercial sex.

Advertisement · Scroll to continue

Additionally, the subpoena sought any communications between the entrepreneur and JPMorgan about Epstein as well as between Musk and Epstein. Documents regarding fees paid by Musk to Epstein or JPMorgan also fall under the subpoena.

HISTORY WITH BANK

The extent of any relationship between Musk and Epstein was unclear. Musk and Tesla vehemently denied speculation in 2019 that Epstein was advising Musk after the Tesla chief ran into trouble with regulators for saying he had lined up the funding to take Tesla private, the New York Times reported.

“It is incorrect to say that Epstein ever advised Elon on anything,” a spokeswoman for Musk told the New York Times at the time.

Musk is the second tech entrepreneur touched by the Virgin Islands litigation. U.S. District Judge Jed Rakoff said earlier this month the territory may serve legal papers on Larry Page, although his ruling did not specify the information sought from the co-founder of Google, which is owned by Alphabet Inc (GOOGL.O).

In a Tesla shareholder lawsuit, Musk testified in January that JPMorgan used to have all of Tesla's commercial banking business, but the relationship soured after the bank did not support Tesla's automotive leasing line.

That trial stemmed from Tesla shareholder claims that a 2018 tweet by Musk stating he had "funding secured" to take the carmaker private had misled investors and caused them billions of dollars in damages. The jury found Musk was not liable.

In 2021, JPMorgan sued Tesla for $162 million over the "funding secured" tweet, alleging it caused the repricing of Tesla stock warrants. Tesla countersued the bank last year, accusing it of seeking a windfall.

After George Soros sold his holding of Tesla stock, Elon Musk accused him of "hating humanity".

www.yahoo.com

www.yahoo.com

Musk sold more Tesla stock than that this year. Eat shit, hypocrite.

Elon Musk Says George Soros, Who Just Dumped His Tesla Stock, ‘Hates Humanity’

The Twitter owner has turned into a full-fledged right-wing conspiracy theorist

Musk sold more Tesla stock than that this year. Eat shit, hypocrite.

It's a minor thing, but he did this by comparing him to Jewish Holocaust survivor turned surprisingly correct super "villain" Magneto.After George Soros sold his holding of Tesla stock, Elon Musk accused him of "hating humanity".

Elon Musk Says George Soros, Who Just Dumped His Tesla Stock, ‘Hates Humanity’

The Twitter owner has turned into a full-fledged right-wing conspiracy theoristwww.yahoo.com

Musk sold more Tesla stock than that this year. Eat shit, hypocrite.

The amount of fawning replies agreeing with the neo-nazi conspiracy theory of Soros being the literal most evil person on the planet because he donates to democrat political causes makes me so sick. I despise these people so much, and wish them nothing but misery and death.After George Soros sold his holding of Tesla stock, Elon Musk accused him of "hating humanity".

Elon Musk Says George Soros, Who Just Dumped His Tesla Stock, ‘Hates Humanity’

The Twitter owner has turned into a full-fledged right-wing conspiracy theoristwww.yahoo.com

Musk sold more Tesla stock than that this year. Eat shit, hypocrite.

I think if you define opposition to Democrats as a neo-Nazi conspiracy theory, the propaganda may have had an effect on you. The man is currently throwing millions at campaigns for district attorney specifically to elect people who will free more murderers and prosecute more Republican politicians, it's not Nazism for a Republican to be mad at that.The amount of fawning replies agreeing with the neo-nazi conspiracy theory of Soros being the literal most evil person on the planet because he donates to democrat political causes makes me so sick. I despise these people so much, and wish them nothing but misery and death.

Completely unrelated;I think if you define opposition to Democrats as a neo-Nazi conspiracy theory, the propaganda may have had an effect on you. The man is currently throwing millions at campaigns for district attorney specifically to elect people who will free more murderers and prosecute more Republican politicians, it's not Nazism for a Republican to be mad at that.

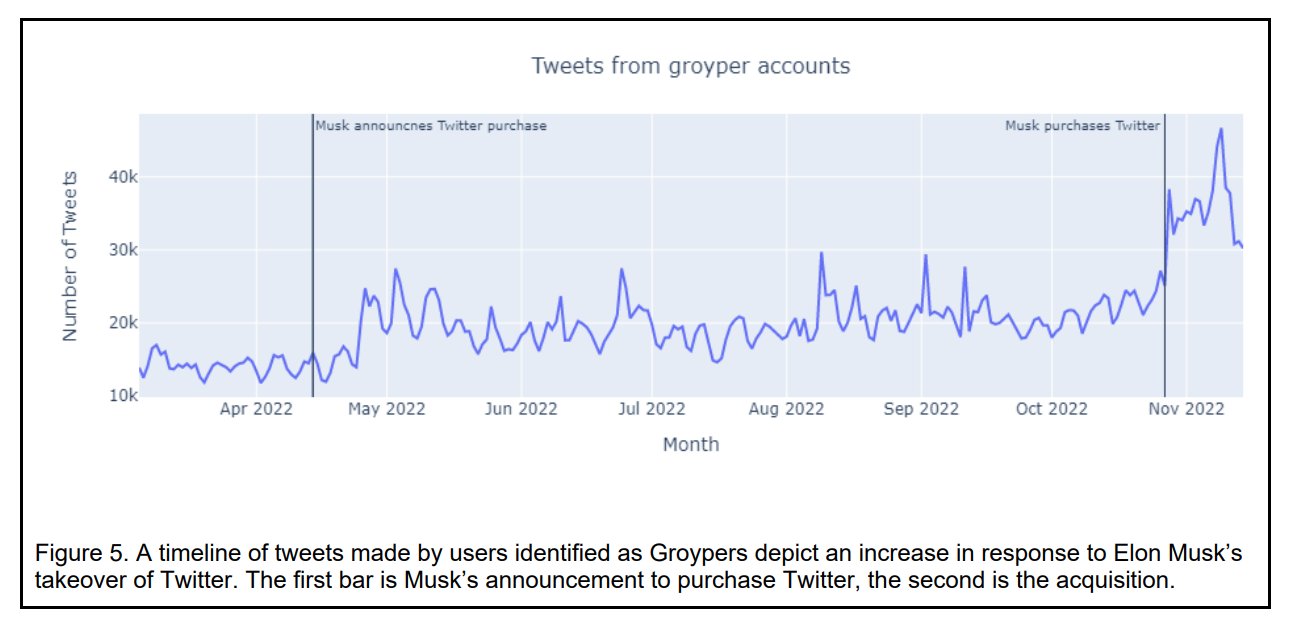

Elon Brings One of America's Most Prominent Nazis Back to Twitter

Neo-Nazi Andrew Anglin has been reinstated to Twitter under Elon Musk’s new policies for the platform.

Elon Musk reinstates white nationalist Nick Fuentes' Twitter account

Fuentes has been advising Kanye West's antisemitic presidential campaign.

Elon Musk Is Turning Twitter Into a Haven for Nazis

Musk has welcomed neo-Nazis back onto the platform, engaged with them on his timeline, and posted multiple tweets that appeal directly to them.

Elon Musk has welcomed another neo-Nazi group back to Twitter

Elon Musk has welcomed another neo-Nazi group back to Twitter

QAnon, racism and ‘informational anarchy’: Experts on how Elon Musk changed Twitter

Those who specialise in monitoring the spread of disinformation say ‘trust and safety are dead’ on the social media platform. Alex Woodward reports

Elon Musk’s Twitter welcomes back neo-Nazis

Britain’s main neo-Nazi group has been ushered back to Twitter under Elon Musk’s ownership.Patriotic Alternative and its leaders, whose profiles had been remov

Since Elon Musk’s Takeover, Twitter Has Seen a Rapid Rise in Gen-Z, Neo-Nazi Antisemitism, New Study Shows | News Direct

A report by the Combat Antisemitism Movement and the Network Contagion Research Institute indicates extremists have flocked to Twitter since Musk’s acquisition and Kanye West’s antisemitic tirades.

Twitter Blesses Extremists With Paid 'Blue Checks'

Dozens of extremists on Twitter now sport the “blue check” once reserved for verified accounts, after signing up for the paid Twitter Blue service under policies instituted by the platform’s new proprietor, Elon Musk.

Noone brings up Soros - including own family who've fallen down these rabbit holes - who doesn't also bring up "the Jews" either through dog whistles or shameless clear antisemitism.

Also we all know republicans don't give a solitary shit about mass murderers being free to mass murder, nice fucking try tho. Thoughts and prayers.

US on track to set record in 2023 for mass killings after series of shootings

Country is seeing an average of more than one mass killing weekly – amid little political prospect of meaningful gun control

There have been more mass shootings than days in 2023, database shows

The Gun Violence Archive shows that there have been more mass shootings than days in 2023 so far.

Still a daily occurrence btw, friendly reminder nothing will be done and no actual solutions are being presented.

-

Actual maybe unrelated slightly;

The ads still up and autoplaying, but surprisingly no replies allowed.

Last edited:

This is true. I would also note that Dorsey had the same situation happen to him in 2014 and told Erdogan noYes, and by my quick read that was a challenge heard in a Turkish court which means the government sent representatives and the courts agreed to hear the case. The government can simply decide it has no case to answer and instruct the court to refuse to hear the case and you can pick any number of nebulous law or policies tucked away in national security and related legislation for that.

So, as much as I dislike the racist and transphobic Dorsey, I give him kudos for that.

I would note that some of these people call THEMSELVEs fascist or (neo)Nazi. I don't know why the bar is at 'opposition to the Democrats'. They have cleared this bar by a whole metre.snip

Because that is the bar set in the post I was responding to:I would note that some of these people call THEMSELVEs fascist or (neo)Nazi. I don't know why the bar is at 'opposition to the Democrats'. They have cleared this bar by a whole metre.

" The amount of fawning replies agreeing with the neo-nazi conspiracy theory of Soros being the literal most evil person on the planet because he donates to democrat political causes makes me so sick. "

Yeah, that's not the bar. That's supporting evidence. I wouldn't call it defining. Maybe this just doesn't matter and we're splitting hairsBecause that is the bar set in the post I was responding to:

" The amount of fawning replies agreeing with the neo-nazi conspiracy theory of Soros being the literal most evil person on the planet because he donates to democrat political causes makes me so sick. "

I don't think Soros is a good person. I do think he is spending a lot of money to make sure he 'protects democracy'. Mainly, his interpretation of democracy. He has smashed economies to make millions. I do think he is trying to stop a Jan 6. He also likes open borders. That doesn't mean he's controlling the planet. Nor does it mean he's the only one doing the same thing. Musk is doing this, Bezos, The Zuck, Gates, Koch bros, Farage... Did you know that there is now a new MBA in the US. It's a Masters of Beef Advocacy. It was created by what is affectionately known as Big Meat. It's wild. Anyway, they're doing it.

But there is a difference between the theories around these people and Soros. They may be bad but generally, the claims can be substantiated. (They are not always actually substantiated but it can be done.) Soros gets blamed for baby sacrifices and the lizard people. Made up stuff that you can't possibly refute because it's not based on logic. Even if you had undeniable proof, it wouldn't prove anything. So, like Trump, we have to spend some extra time on every allegation to check its validity.

Well, I should say I, not we. I don't think everyone does this.

Ron DeSantis Signs Bill Protecting Elon Musk If His Rockets Explode and Kill Workers

DeSantis signed the bill just one day after his presidential announcement alongside Musk.

Ah, yeah, that one's been floating about a bit beforehand, Bezos is involved also. It's flagrantly psychopathic, how in the fuck anyone can even think to defend it is beyond me. How can anyone think capitalism is good for us with shit like this being done? More money spent on lobbying to legally get away with murder than anything mildly close to healthcare and safety of citizens. This is its true nature and always fucking will be.Oh, so that's why.

Ron DeSantis Signs Bill Protecting Elon Musk If His Rockets Explode and Kill Workers

DeSantis signed the bill just one day after his presidential announcement alongside Musk.newrepublic.com

Ok Florida needs to go. Deep underwater, into space or nuked from orbit, doesn't matter which - get that toxic failed experiment as far away from humanity as we can....the bill passed the state Senate 39–0 and state House 107–5.

Last edited:

So, hypothetically, could Musk get angry with one of his workers and shoot a rocket at them in some Bond villain execution?

...

Actually, if someone shoots one of Musk's rockets at him, is it a crime?

...

Actually, if someone shoots one of Musk's rockets at him, is it a crime?

https://www.dw.com/en/eu-twitter-leaves-voluntary-pact-on-fighting-disinformation/a-65751487

Considering that the EU user count is not that high in the first place, Twitter might leave EU instead of conforming to the regulations coming in august.

Considering that the EU user count is not that high in the first place, Twitter might leave EU instead of conforming to the regulations coming in august.

Here, I'll let you in on a little secret. You don't actually live in a Capitalist society. Anyone who says otherwise is lying to you or naive.Ah, yeah, that one's been floating about a bit beforehand, Bezos is involved also. It's flagrantly psychopathic, how in the fuck anyone can even think to defend it is beyond me. How can anyone think capitalism is good for us with shit like this being done? More money spent on lobbying to legally get away with murder than anything mildly close to healthcare and safety of citizens. This is its true nature and always fucking will be.

Ok Florida needs to go. Deep underwater, into space or nuked from orbit, doesn't matter which - get that toxic failed experiment as far away from humanity as we can.

I can't help but feel like this has been Twitter's final form. It never has been good with actually providing people with information. Just craphttps://www.dw.com/en/eu-twitter-leaves-voluntary-pact-on-fighting-disinformation/a-65751487

Considering that the EU user count is not that high in the first place, Twitter might leave EU instead of conforming to the regulations coming in august.

It's social media, not journalism. Think of how stupid the average person is, realize that by definition half the population is more stupid, and now give each and every one of those morons their own personal megaphone.I can't help but feel like this has been Twitter's final form. It never has been good with actually providing people with information. Just crap

Not necessarily, theoretically you could have a large group of somewhat above average people and then a smaller group of catastrophically below average people.Think of how stupid the average person is, realize that by definition half the population is more stupid

Of course, you could also have it the other way around, but people who tend to believe in that version tend to be insufferable.