Bootstraps, American Dream, Communism and at some point the 2nd Amendment, most likely.So my question to you is why should people get paid nothing to sit on their ass in the future while people are struggling to make ends meet in a gig economy in the future on the labor of people who actually work.

GameStop Stock surges due to meme traders

- Thread starter TheMysteriousGX

- Start date

That's pretty much my take on it.The idea is that a whole lot of people will lose a tiny bit of money each in order to give it to the billionaire hedge fund manages by making them go bankrupt. Unlike them, we're not doing this to make a profit.

Only the opportunists who are gonna jump in looking to exploit this moment for their personal gain will invest any notable sum that they'd actually mind losing here, and those, well, they should lose it because it isn't about making money, it's about sticking it to those who sacrifice others to make money.

I mean, up until two or three days ago you could have made a damned convincing case this was a pump-and-dump scheme by a handful of people on WSB, seizing personal animus felt by most folks to use killing Melvin and Citadel as a rallying cry. Honestly it still wouldn't surprise me if a good number of the bigger investors on WSB still dump at some point before Melvin's margin call tomorrow. But once the hedge funds and media started fighting back and all but declared total war on retail investors, it got personal and I think a lot of people who would have quietly dumped and had a good laugh about it are now hellbent for leather on holding just to see the reptilian bastards on Wall Street bleed.

Whatever this was before, it's a protest movement now and it's the actions of Melvin, Citadel, and bad-faith actors on their behalf which made it so. If they'd kept their mouths shut and not thrown a tantrum, most of that GME stock would have likely gotten dumped in the last 24 hours.

Were they actually the poor? Weren't they amateur stock enthusiasts and market dabblers?

- Feb 7, 2011

- 8,696

- 3,266

- 118

- Country

- 'Merica

- Gender

- 3 children in a trench coat

Compared to hedge fund managers everyone is the poor.Were they actually the poor? Weren't they amateur stock enthusiasts and market dabblers?

Why use the word 'future'? "If you have around 1 million in stock that's 30 thousand in dividends... [P]eople get paid nothing to sit on their ass... while people are struggling to make ends meet in a gig economy" is the present. And if you remove 'gig economy', it's also the past going quite a ways back with perfect continuity.The problem with Wall Street is that in the future when accountants and financiers are automated out of existence. There will be an investor class with billions in assets, and millions in dividends/ payments you get for owning the stock.

For example, if you have around 1 million in stock that's 30 thousand in dividends. So my question to you is why should people get paid nothing to sit on their ass in the future while people are struggling to make ends meet in a gig economy in the future on the labor of people who actually work.

I mean, no shit. Black box trading has been around for decades. Hell, the most infamous example of it were the massive number of United and American airlines shorts the month before 9/11, that were investigated and discovered to be nothing more than automated trades tailing the ass end of the dotcom bust because analysts were predicting a slow-down of the airlines industry.Why use the word 'future'? "If you have around 1 million in stock that's 30 thousand in dividends... [P]eople get paid nothing to sit on their ass... while people are struggling to make ends meet in a gig economy" is the present. And if you remove 'gig economy', it's also the past going quite a ways back with perfect continuity.

A "future" thing this ain't, it's a "twenty years ago" thing and most folks just haven't clued into it because it isn't a huge topic of discussion.

- Feb 7, 2011

- 8,696

- 3,266

- 118

- Country

- 'Merica

- Gender

- 3 children in a trench coat

This is how the show Billions should end in the final season, with Ax Capital driven out of business by retail investors.

There is a chance that Robinhood restricting buys had a specific money related reason to happen: brokers need to use their own cash as collateral, and not mine, when buying stock because it's not instantaneous, and if too much stock is moving too quickly they might not've had the cash reserves to do it...

but for an entire day? Looks super bad, needs investigated,

but for an entire day? Looks super bad, needs investigated,

In the end, from all this, the sum total of money in the world will not change. When a whole lot of small people lose money, and a hedge fund loses money... who's gaining money?The idea is that a whole lot of people will lose a tiny bit of money each in order to give it to the billionaire hedge fund manages by making them go bankrupt. Unlike them, we're not doing this to make a profit.

Only the opportunists who are gonna jump in looking to exploit this moment for their personal gain will invest any notable sum that they'd actually mind losing here, and those, well, they should lose it because it isn't about making money, it's about sticking it to those who sacrifice others to make money.

Try reading "By Light Alone" by Adam Roberts. It's a semi-humorous vision of a society with an effete and totally idle elite class who live entirely off investments, with a severely attenuated and insecure middle class doing the few jobs that have resisted automation, and the masses been forcibly genetically modified to grow photosynthetic hair so they don't even need to be paid welfare any more.The problem with Wall Street is that in the future when accountants and financiers are automated out of existence. There will be an investor class with billions in assets, and millions in dividends/ payments you get for owning the stock.

For example, if you have around 1 million in stock that's 30 thousand in dividends. So my question to you is why should people get paid nothing to sit on their ass in the future while people are struggling to make ends meet in a gig economy in the future on the labor of people who actually work.

Nah the hedge funds are losing way more money, they've already lost something like 4 billion dollars and I seriously doubt the investors in reddit put up anything remotely close to that even combined.In the end, from all this, the sum total of money in the world will not change. When a whole lot of small people lose money, and a hedge fund loses money... who's gaining money?

And as for who is gaining money, there are some small investors making some money off of this, but that's more of a side benefit, this isn't about the money, it's about spending money to make market manipulating assholes go bankrupt.

Like they say, you have to break a few eggs to make an omelette. If reddit's hijinx contributes to large investors losing faith in hedge funds and huge investment firms I'd say it's well worth it.Take this reasoning one step further: What happens when a major investment and stock broking firm goes bankrupt? The people running it might be assholes, but they are also most likely responsible for hundreds of millions (or more) of investments for ordinary people, unions, retirement funds etc.. If they go bankrupt some people might see their retirement money vaporize. That's on top of the destabilizing factor of a major investment firm going broke will have on the economy at large. The people that will pay the price in another recession is not some investment banker but all the people who loses their jobs and their homes. It is everyone who pays taxes when states need to step in to save major banks to prevent a worsening of recession.

As a gotcha to prove that shorting is bad it was a fun lark. As an extended attempt to fuck with the economy, it is a dangerous game of chicken that no one can benefit from and everyone stands to lose from.

Like houseman said short selling itself isn't the problem. The problem is with hedge funds preying on devaluation to manipulate the stock price. That reddit now used that approach against them is actually kind of brilliant. It shows how vulnerable hedge funds are by putting all their eggs in one basket.

The end game is regulations being put in place to prevent market manipulation by everyone. Shorting a stock is the same sort of act, it shouldn't be an issue only when normal people use it.Take this reasoning one step further: What happens when a major investment and stock broking firm goes bankrupt? The people running it might be assholes, but they are also most likely responsible for hundreds of millions (or more) of investments for ordinary people, unions, retirement funds etc.. If they go bankrupt some people might see their retirement money vaporize. That's on top of the destabilizing factor of a major investment firm going broke will have on the economy at large. The people that will pay the price in another recession is not some investment banker but all the people who loses their jobs and their homes. It is everyone who pays taxes when states need to step in to save major banks to prevent a worsening of recession.

As a gotcha to prove that shorting is bad it was a fun lark. As an extended attempt to fuck with the economy, it is a dangerous game of chicken that no one can benefit from and everyone stands to lose from.

Yes, that's pretty much right. The value is notional until someone pays over money, as with anything else. However, at any one point, at least someone somewhere is likely to be buying/selling in any major company, so the share value represents in a very real way what people are paying for shares, even if the number of shares being traded is a small percentage of the total number of shares for the company. In that sense, the total amount to be won/lost by active investors also depends on the volume of shares being traded. If people are going crazy over just 5% of the shares whilst long-term investors hold on to 95% throughout the frenzy, it might not actually be that much money changing hands.From my very layman understanding of the stock market, isn't the problem that a lot of the "value" derived from it isn't actual Cash in Pocket money but a sort of estimation consensus of how much companies are worth? Which means that I might think I have 10 million in gamestop stocks but it isn't actually money until I sell the stock and get to collect. In cases like this it means that everyone is a loser because a stock is just losing value and everyone who owns that stock is short the money of their investment. No one profits from this, not Gamestop, not the stock brokers and speculation traders and certainly not the small people who did this just to spite the traders.

To me it seems like a really stupid (if undeniably effective) way of showing how senseless the stock market really is, because at the end of the day a lot of people just lose money and some dudes on the Chans are fist pumping and cheering for sticking it to the man. But we don't need channers doing this to have undeniable proof that the stock market is a fickle and bad mistress. We can look at 1929, 1979, 2008 and a whole other string of recessions to realize that when the stock market is disrupted everyone suffers, everyone loses money and a lot of innocent people who can't do anything about it loses their jobs, their homes and some times their lives.

In case anyone is still confused about what happened, Stephen Colbert did a rundown in his own inimitable style

You know shit ain't right when Ben Shapiro and AOC agree on something.

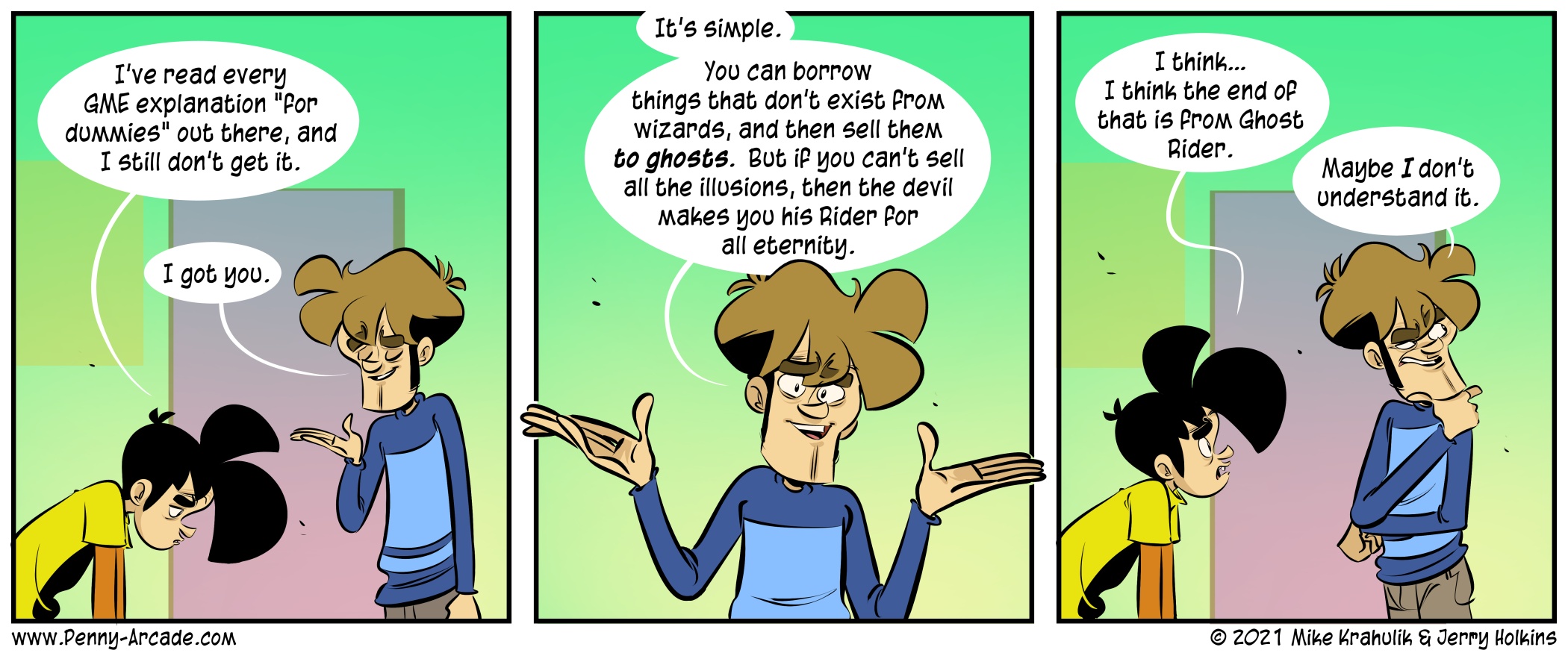

I dunno, I think Tycho's take on the issue is more cinematic.In case anyone is still confused about what happened, Stephen Colbert did a rundown in his own inimitable style

No I don't quite think that's it.Well the news doesn't they're now blaming the action on Trumpism

Analysis: How Trumpism explains the GameStop stock surge

At the core of Donald Trump's angry populist appeal was -- and is -- this sentiment: The elites think they know better than you. They think they can tell you how to live and what to believe. But guess what? We the people are smarter than the elites!edition.cnn.com

Firstly because of the obvious reason that those that get annoyed enough over shady stock practices to take action are statistically not likely to be Trump supporters. Trump supporters have lionized corruption for years now.

But I also think its to simplified they are simple annoyed or even angry with the elites. That's certainly part of it. In fact populism views everything as a death battle between one pure, united and holy people and an eternally evil bunch of nebulously defined elites. These people don't want to ''annoy'' the elites but destroy them entirely.

But its exactly this nebulous definition of elites that ensure that populists aren't exactly anti elites in their entirety. In fact with Trump they colluded with the elites rather than opposing them, putting an elite in power, who gave cabinet positions to the elites to enact an agenda beneficial to the elites. At its most anti elite Trump was merely the attempt to replace the political elite with the business elite. Remember that when interviewed Trumpsters often said Trump being a businessmen was a positive and that America should be run as a business. Ergo, their distaste is primarily for the political elite and not so much the financial elite which stockbrokers are a part of. And its not much different in other places. Brexit is the baby of the Tory party, hardly a friend of the working class and in many populist parties enact a right wing platform that benefits big business over the little guy.

Some of those populist voters are merely duped into voting against their own best interest. But others know what they are doing. Rather than being opposed to the elite as a whole they seek to replace the elite with one more in line with their own thinking. Still rich, old and out of touch white men but rich, old and out of touch white men who are emotional and ''macho'' rather than technocratic, who wish to pursue an isolationist course rather than a global one, and who value tradition over progress.